If you are new to saving and you want to know the right place to start beyond your employer-sponsored retirement plan, then you may want to consider either a Traditional IRA or a Roth IRA. If these terms are foreign to you, then you've found the right blog to read. If you’re familiar with IRAs, then hopefully you’ll learn something that you had not known before. Let's start with the basics: what is an IRA? IRA stands for Individual Retirement Account. The Employee Retirement Income Security Act of 1974 introduced the IRA, while the Taxpayer Relief Act of 1997 introduced the Roth IRA. So what is the difference between these two types of accounts?

Traditional IRA

A Traditional IRA is a tax-deferred retirement account. Tax-deferred means that the money you deposit into the account is not taxable. However, you will pay taxes when you take money out of the account. You need to know some rules about your contributions to this account and the distributions from the account.

Contributions

Contributions into a Traditional IRA account have to come from earned income. Earned income can be money from wages, salaries, tips, professional fees, bonuses, commissions, and self-employment. The following does NOT qualify as earned income: earnings and profits from property, interest and dividend income, pension or annuity income, deferred compensation, income from certain partnerships, and any amounts you exclude from income. As mentioned above, the contributions made into this account are not taxable. Another term you may hear is pre-taxed. Pre-taxed means that you are funding the account with money you have not paid taxes on yet. So how does this work? Well, here is an example:

Let's say you contribute $4,000 into a Traditional IRA. At the end of the year, when you're preparing your taxes, the tax software will ask you if you made any contributions to a retirement account; you'll click yes and select Traditional IRA. You will also receive a Form 5498 in the company's mail that you have the account with confirming that you did make that $4,000 contribution. When you've completed preparing your taxes, you will see your total income minus the $4,000 (minus any additional above the line deductions) to arrive at your adjustable gross income. The adjustable gross income is the income used to derive your taxable income, which calculates your tax liability.

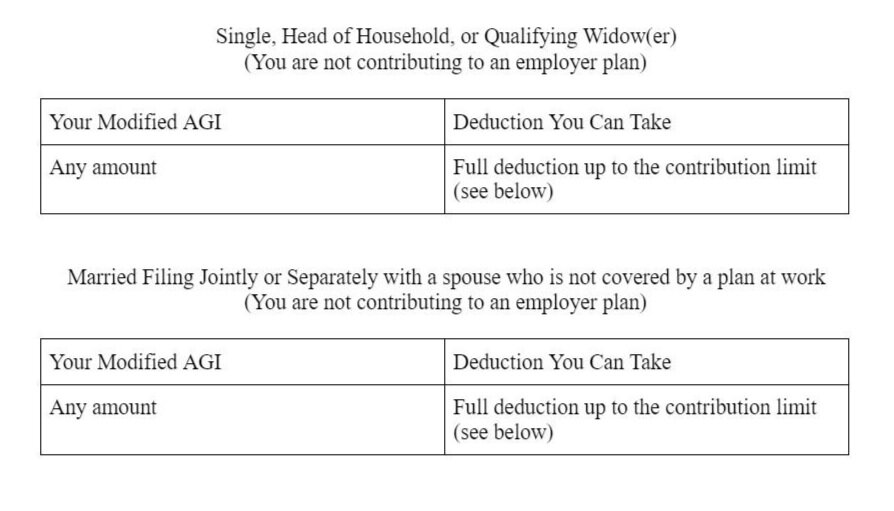

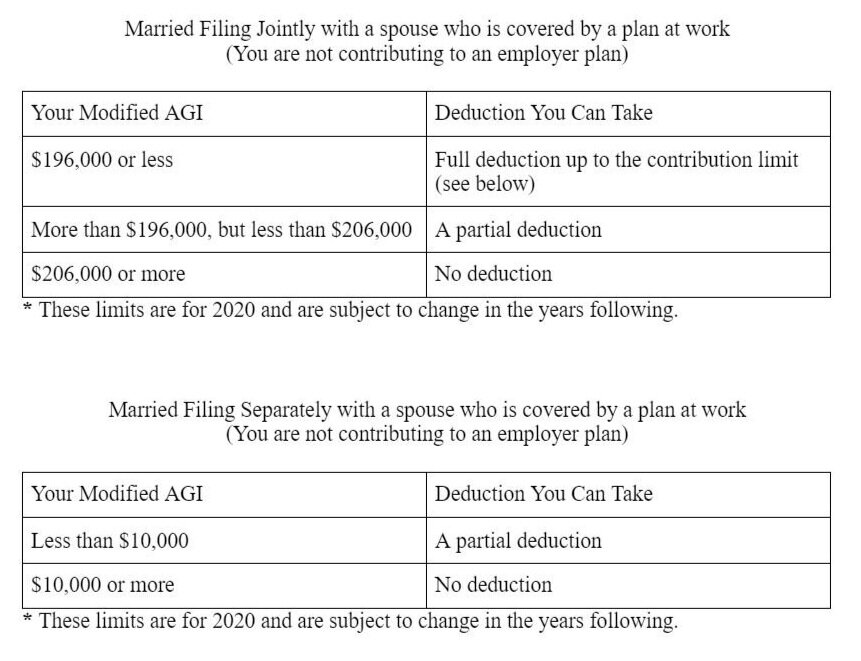

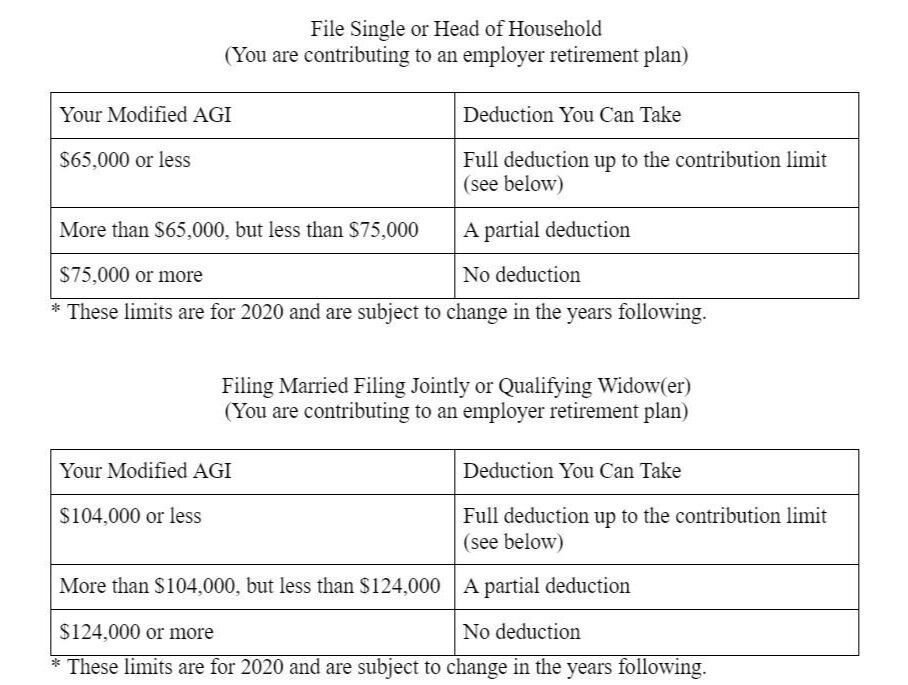

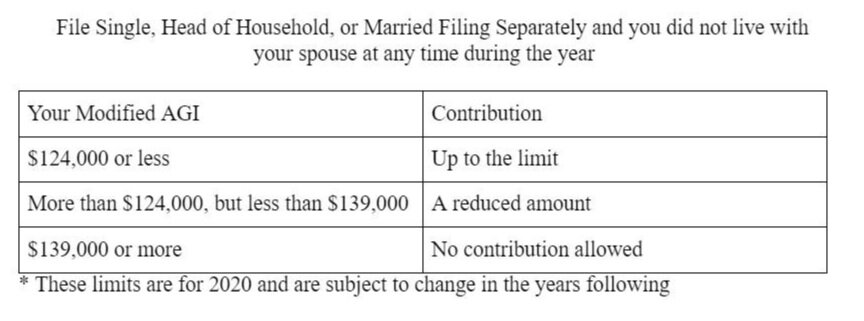

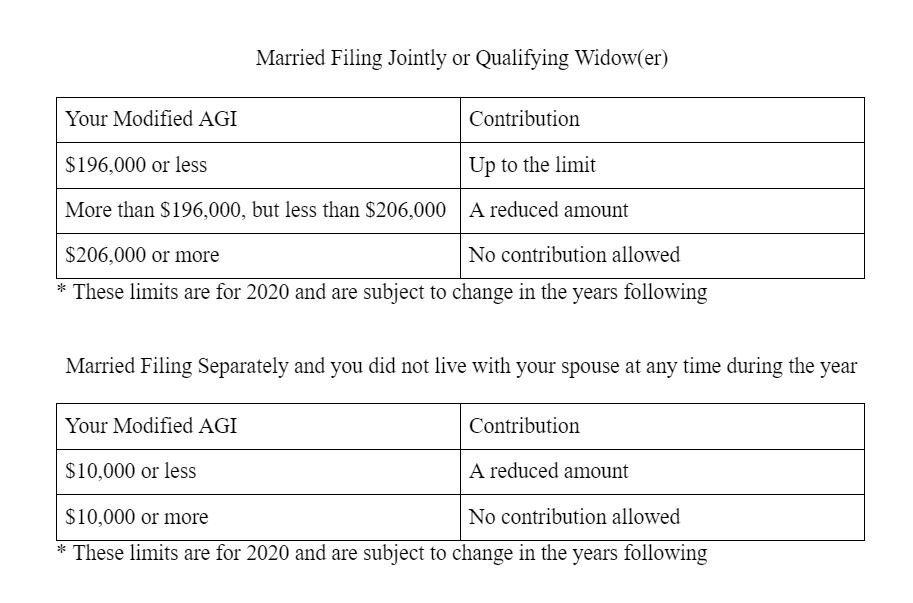

Please note, there are income phaseouts and limits to determine if you can contribute to an IRA account in order to get a deduction for your contribution. A couple of parameters determine the phaseouts and income limits, how you file your taxes, and whether you can access a retirement plan through work. The phaseouts and limits are as follows:

As of 2020, if you are under age 50, you can contribute $6,000. If you are over 50, you are allowed to contribute $1,000 in addition to the $6,000 for a total of $7,000. You can make contributions as long as you are working; there is no longer an age limit when contributions stop.

Distributions

Now, you're making contributions each year, and your contributions are earning you money because they invest, so your account grows. Since the government was generous to allow you to put all this money into an account without paying taxes, they will eventually want to get paid for their generosity. Therefore, they require you to take distributions from the account at age 72 (was age 70 ½ before the legislation passed the CARES Act of 2019) if you are no longer working and earning income. If you are still working, you will not have to take a distribution and the government will allow you to continue to contribute to the IRA. You have the ability to take the money out before age 72; however, if you take money from the account before age 59 ½, you will have to pay a 10% penalty. This penalty is in addition to the income tax you will have to pay for the money you take out.

Roth IRA

A Roth IRA is a tax-free retirement account. A tax-free retirement account means that the qualifying distributions from this account are tax-free to you. Like with the Traditional IRA, there are some rules that you need to know about the contributions and distributions for this account.

Contributions

As with the Traditional IRA, contributions into a Roth IRA have to come from earned income. The difference between the contribution to the Roth IRA vs. the Traditional IRA is the contributions into the Roth IRA are with taxed money. Let's look at an example of how this works.

You contribute $4,000 into the Roth IRA account. When you're preparing your taxes at the end of the year, the tax software will ask you if you made any contributions to a retirement account, and you'll click yes and select Roth. You will also receive a Form 5498 in the company's mail that you have the account with confirming that you did make that $4,000 contribution. When you've completed preparing your taxes, you will see the $4,000 was not subtracted from your income to arrive at your adjustable gross income. Therefore, you end up paying taxes on the $4,000 that you contributed to the Roth IRA.

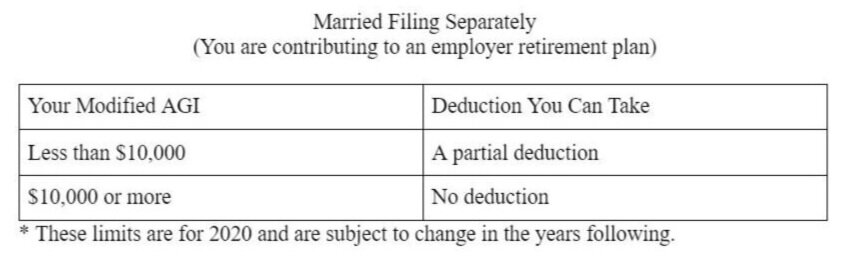

There are contribution limits on the amount that you can deposit into a Roth IRA account. The amounts are the same as the Traditional. If you're under 50, you can contribute up to $6,000, and if you're over 50, you can contribute $1,000 in addition to the $6,000. If you were to have both a Roth IRA and a Traditional IRA, the contributions are aggregated between the two. Also, like with Traditional IRAs, there are income phaseouts and limits to determine if you can contribute to a Roth IRA. These phaseouts and limits are as follows.

When deciding on which retirement account is the best for you, it comes down to your specific situation and what you want to accomplish. As a client with Fortitude Financial Planning, we will evaluate your current situation, dive into what your goals are, and help you decide which is the best option for you, if any. There may be other tools we need to use to help you accomplish your goals.

I hope this provided some further insight into IRAs, and helped you better understand your options. If I can help you understand further, or if you want to have a discussion about which option may be right for you, please reach out, I would love to speak with you.

Sincerely,

Travis Tracy, CFP®, EA